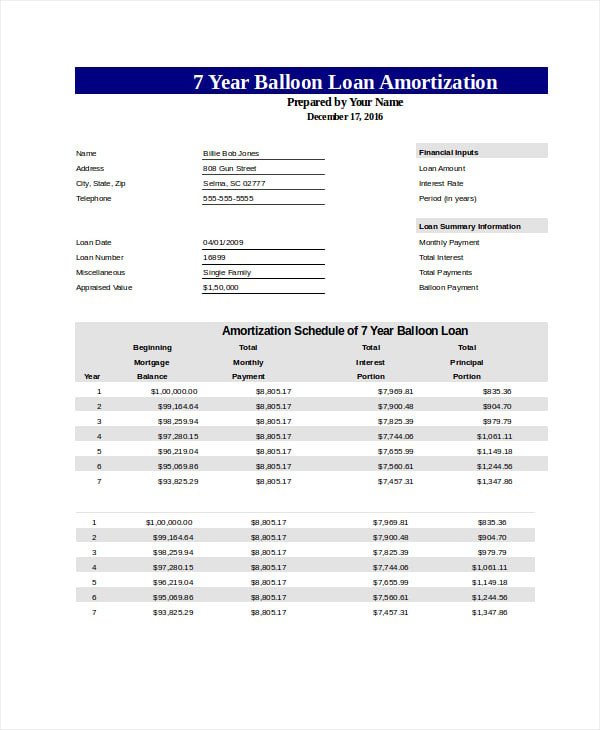

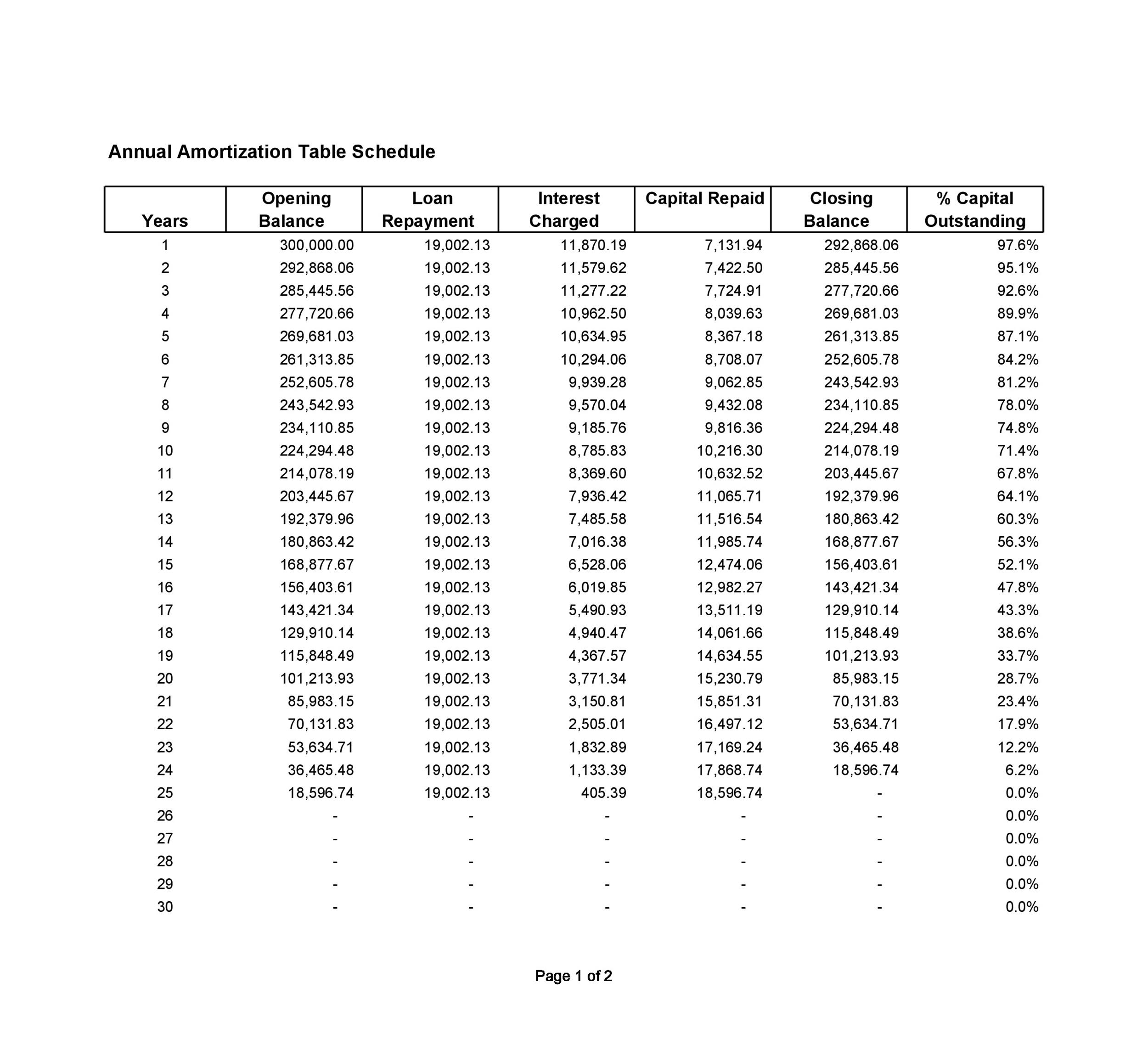

Easily seeing where all the formulas are in your worksheet can be handy. How much principal you owe on the mortgage at a specified date. Mortgage experts predict what will happen to rates over the next week - and why. Use the Fill Down feature of Excel to create the rest of the table. If you would like a copy of the spreadsheet developed here,click here to download a copy. The calculator updates results automatically when you change any input. When you download Excel spreadsheets from the web they download in PROTECTED VIEW. You need to click on in the yellow banner at the top of the spreadsheet to change variable amounts. Mortgage CalculatorĬheck your refinance options with a trusted local lender. For example, if your loan is for $150,000 at 6 percent interest for 30 years, your loan payment will calculate out to $899.33. If you do not receive a final ending balance of $0.00, make sure you have used the absolute and relative references amortization definition as instructed and the cells have been copied correctly. The sum should be equal to the value in the Payment column in the same row. Can you please explain so I can use this to prepare amortization schedules. The closing balance of the lease liability should unwind to zero. payment number, payment, principal, interest) till 20. We will drag the first four columns (i.e. And this formula returns the payment calculation from above. The ending loan balance for the period is equal to the prior loan balance minus the principal portion for the period. The interest amount for the period is equal to the periodic interest rate times the prior period’s ending balance. The in-depth Watch Me Build is a 25 minute behemoth, showing you how to build a more complex, dynamic amortization table in Excel. You should see that the balance reaches zero with the last payment. Interest Rate Implicit In The Lease Under Ifrs 16.

0 kommentar(er)

0 kommentar(er)